South Korea has 24 million 5G subscribers and

Jul 8, 2022 · Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to previous reports. This figure is

South Korea, June 2022, Mobile Network Experience Report

Market Overview There were over 22 million 5G subscribers in South Korea at the end of March 2022 which represented a penetration rate of 45%, served by 215,000 5G base stations. South

South Korea''s capital Seoul ends March with 37,680 5G base stations

Apr 18, 2022 · Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to the latest available figures from the country''s Ministry of

South Korea ends February with almost 203,000 5G base stations

Mar 31, 2022 · Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, Korean press reported, citing figures from the country''s Ministry of

37,680 5G Base Stations Operating in South Korea''s Capital

Apr 21, 2022 · The average number of 5G base stations per district in Seoul is estimated at 1,507 units South Korea''s capital Seoul ended March with a total of 37,680 5G base stations,

Optimal Solar Power System for Remote

Jan 24, 2019 · Abstract: This paper aims to address both the sustainability and environmental issues for cellular base stations in off-grid sites. For cellular network operators, decreasing the

Seoul concentrates 44% of the total 5G base stations in Korea

Nearly half of 5G base stations in South Korea are concentrated in the greater Seoul area, while other regions in the country are lagging behind in terms of the deployment of base stations,

Optimal Solar Power System for Remote

Dec 21, 2023 · Figure2shows the number and locations of the LTE base stations deployed in South Korea by mobile operators, where SK Telecom has 52,000, LG U+ has 70,717, and KT

6 FAQs about [Mobile operator base stations in Seoul]

How many 5G base stations are there in South Korea?

South Korean telecom operators currently provide 5G services via Non-Standalone (NSA) 5G networks, which depend on previous 4G LTE networks. Korean mobile operators have deployed a total of 202,903 5G base stations as of the end of February, according to previous reports.

Which South Korean mobile providers use a 5G non-standalone network?

Among South Korean mobile providers, both LG U+ and SK Telecom use a 5G non-standalone (NSA) network configuration, where voice is delivered via VoLTE (using the 4G network), while KT employs a 5G standalone (5G SA) network, where voice is carried over the 5G new radio (VoNR).

How many 5G base stations are there in India?

The country’s three operators have deployed 166,250 5G base stations which is approximately 19% of the country’s 870,000 4G base stations. Deploying a new network technology is expensive for mobile operators.

What is the mobile voice call performance of South Korea?

The chart has 1 Y axis displaying Mobile Voice Call Performance. Data ranges from 0 to 1.435. South Korea stands out as a global leader in 5G technology and adoption, having launched the first commercial 5G networks in April 2019, and is investing heavily in next generation technologies, with a strong focus on AI and 6G.

How many 4G subscribers are there in South Korea?

The number of 4G subscribers in South Korea reached 47 million as of the end of May. Also, mobile virtual network operators in the Asian nation had a combined 83,256 users as of the end of the month. South Korean telecom operators currently provide 5G services via Non-Standalone (NSA) 5G networks, which depend on previous 4G LTE networks.

Does South Korea have 5G?

South Korea was the first country to launch commercial 5G networks in April 2019 and currently has 5G coverage across its 85 cities The total number of 5G subscribers in South Korea reached nearly 24 million in May, Korean press reported, citing data from the Ministry of Science and ICT.

Learn More

- Albania has mobile power signal base stations

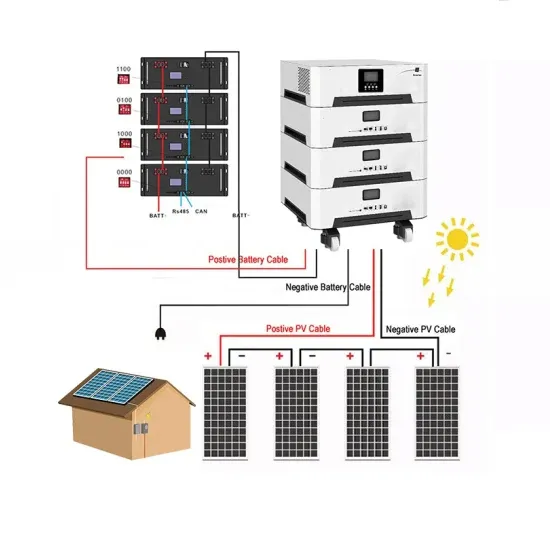

- New energy battery for mobile base stations

- Principle of solar power generation for mobile base stations

- Wind-solar complementarity for mobile communication base stations

- Building small solar mobile base stations in remote areas

- Mobile energy storage backup power for base stations

- Mobile communication 4g and 2 5g base stations

- Lithium-ion batteries for three communication base stations in Baghdad

- What is wind power used for communication base stations

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.