Norwegian partners to kick-start Green Maritime

Jun 17, 2025 · Ocean Hyway Cluster, a Norwegian network for hydrogen-based solutions for the maritime sector, and its consortium partners are set to initiate

Offshore wind farm site selection in Norway: Using a fuzzy

Jan 10, 2024 · Furthermore, the energy economic calculations are carried out to provide support for the proposed decision-making framework. The proposed methodology was tested through

Map of Power Plants In Norway

Mar 22, 2025 · 2. Types of Power Plants in Norway Hydropower Plants: Hydropower is the backbone of Norway''s electricity generation, with hundreds of hydroelectric plants spread

Norway — IEA Geothermal | International Energy

Aug 5, 2024 · There are preliminary plans for utilizing deep geothermal energy in a district heating scheme in in Ny Ålesund, a remote settlement in Artic

EV Charging Index: Expert insight from Norway

Aug 18, 2025 · The new national charging strategy focuses on numerous factors to improve infrastructure for both passenger vehicles and, increasingly, commercial vehicles. Chief aims

Top five hydro power plants in operation in Norway

Sep 9, 2024 · Listed below are the five largest active hydro power plants by capacity in Norway, according to GlobalData''s power plants database. GlobalData uses proprietary data and

Mobile base station site as a virtual power plant for grid

Mar 1, 2025 · Furthermore, it seeks to determine if the full activation time can meet the requirements of an FFR product. The system consists of a live mobile base station site with a

Leveraging Clean Power From Base Transceiver Stations for Hybrid

Feb 28, 2025 · Leveraging Clean Power From Base Transceiver Stations for Hybrid and Fast Electric Vehicle Charging Stations System With Energy Storage Devices Abstract: Numerous

Grid-connected renewable energy systems flexibility in Norway

Oct 1, 2023 · This research analyzes the optimization of a hydro plant, wind turbines, and photovoltaic (PV) panels with a careful examination of three scenarios in the Hinnoya region,

A hybrid perspective on energy transition pathways: Is hydrogen

Aug 1, 2021 · Hydrogen may play a significant part in sustainable energy transition. This paper discusses the sociotechnical interactions that are driving and hindering development of

Hydrogen Stations Norway. Map and List

Aug 14, 2024 · Norway currently has a total of 9 hydrogen stations open to the public, spread across strategic areas to maximise their use and accessibility. Current projects focus on

Experiences from the introduction of a hybrid energy and

Jun 20, 2024 · A public consultation on new tariffs was performed in Norway 2015, and in 2019 the research project ForTa was established with the aim of realizing demand response and

6 FAQs about [Are there any hybrid energy base station sites in Norway ]

How many hydrogen stations are there in Norway?

Norway currently has a total of 9 hydrogen stations open to the public, spread across strategic areas to maximise their use and accessibility. Current projects focus on improving green hydrogen production capacity and expanding the network to new regions, with an emphasis on the west coast and the north of the country.

Does Norway have a hydrogen fuel cell network?

CLICK HERE! Norway has been a pioneer in the transition to renewable energy and the use of hydrogen as a clean fuel. In recent years, the country has stepped up its efforts to develop a network of hydrogen stations, with the aim of supporting the adoption of hydrogen fuel cell vehicles.

Who are the main hydrogen filling station operators in Norway?

The main hydrogen filling station operators in Norway are: Uno-X: Uno-X Hydrogen is one of the main hydrogen station operators in Norway. The company has been instrumental in expanding the station network in the country, and continues with ambitious plans to increase national coverage.

Does Norwegian hydrogen have a new hydrogen plant in Rjukan?

Norwegian Hydrogen has now made the investment decision for a new hydrogen plant in Rjukan, Telemark in Norway. This is part of the company’s strategy, which includes existing production of green hydrogen and several new projects currently under development across the Nordic region.

Can hydrogen be used for stationary power in Norway?

In the industry sector, some actors are willing to experiment, but large parts of the industry have an energy and capital-intensive structure, where hydrogen solutions will require risky and costly process change , . Due to the high share of flexible hydropower, there has been less focus on hydrogen for stationary power in Norway.

How does Norwegian hydrogen drive the green transition?

Norwegian Hydrogen drives the green transition through the development and operation of green hydrogen infrastructure, aimed primarily towards heavy-duty transport and maritime customer segments. We will provide infrastructure including production facilities, distribution systems and a wide network of filling and bunkering stations.

Learn More

- The line next to the hybrid energy of the communication base station

- General process of hybrid energy in base station room

- Jakarta hybrid energy 5g signal base station

- How much does a wind-solar hybrid energy storage cabinet for a communication base station cost

- Castries hybrid energy 5g base station photovoltaic power generation system planning

- 5G base station of Slovakia Hybrid Energy Branch

- How many sites are there in the Madrid Communication Base Station Energy Management System

- Hybrid Energy 5G Base Station Outdoor Power Station Procurement

- Does the energy storage cabinet for wind and solar hybrid communication base station have batteries

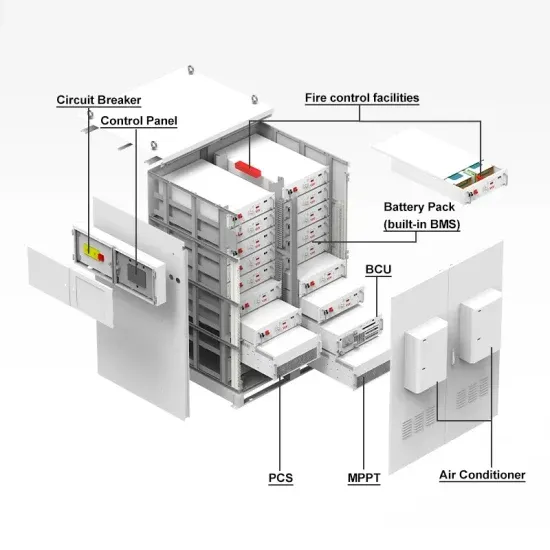

Industrial & Commercial Energy Storage Market Growth

The global industrial and commercial energy storage market is experiencing explosive growth, with demand increasing by over 250% in the past two years. Containerized energy storage solutions now account for approximately 45% of all new commercial and industrial storage deployments worldwide. North America leads with 42% market share, driven by corporate sustainability initiatives and tax incentives that reduce total project costs by 18-28%. Europe follows closely with 35% market share, where standardized industrial storage designs have cut installation timelines by 65% compared to traditional built-in-place systems. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing scale reducing system prices by 20% annually. Emerging markets in Africa and Latin America are adopting industrial storage solutions for peak shaving and backup power, with typical payback periods of 2-4 years. Major commercial projects now deploy clusters of 15+ systems creating storage networks with 80+MWh capacity at costs below $270/kWh for large-scale industrial applications.

Industrial Energy System Innovations & Cost Benefits

Technological advancements are dramatically improving industrial energy storage performance while reducing costs. Next-generation battery management systems maintain optimal operating conditions with 45% less energy consumption, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $85/kWh to $40/kWh since 2023. Smart integration features now allow multiple industrial systems to operate as coordinated energy networks, increasing cost savings by 30% through peak shaving and demand charge management. Safety innovations including multi-stage fire suppression and thermal runaway prevention systems have reduced insurance premiums by 35% for industrial storage projects. New modular designs enable capacity expansion through simple system additions at just $200/kWh for incremental capacity. These innovations have improved ROI significantly, with commercial and industrial projects typically achieving payback in 3-5 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (1-2MWh) starting at $330,000 and large-scale systems (3-6MWh) from $600,000, with volume discounts available for enterprise orders.